I just finished reading thought provoking article on CNBC where they did an interview of self made millionaire David Bach on how to build wealth. In this article, he states that for a millennial to start building wealth for their future, they need to invest in real estate.

I just finished reading thought provoking article on CNBC where they did an interview of self made millionaire David Bach on how to build wealth. In this article, he states that for a millennial to start building wealth for their future, they need to invest in real estate.

Watch the video below of an interview with millionaire David Bach where he discusses the best way to generate wealth.

Money Trap or Wise Investment?

He states that the average homeowner is 38 times wealthier than a renter which makes complete sense to me. Just think, if you rent a home in Myrtle Beach for the next 30 years at simply a rental rate of $1,300, and the market does not increase during that time, you will have thrown away $468,000 on rent in which you have not accumulated a penny of equity. On the other hand if you were to purchase a home and take the next 30 years to pay off the mortgage, you would have own your home free and clear and have all that equity wealth.

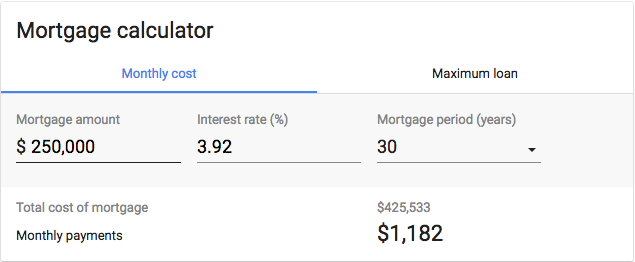

Take a look at the mortgage calculations below:

While yes, you are paying a bunch of interest over the life of your loan, you are still going to save an additional $42,467 in what you would pay in rent. Meanwhile, during the 30 years that you are paying off the loan, your home should continue to increase in price. Historically, home values had seen a steady incline (other than the bursted bubble of 2006-2012) in prices. At the end of the same time period you will have $250,000+ in equity save into your portfolio as well as saving the difference between renting vs owning.

You Gotta Live

Unless you plan on living the rest of your life in your vehicle, you have to live somewhere. The question is, are you planning on spending those years paying rent and throwing away money, or are you planning on spending that time investing into your future by paying on a mortgage and increasing your wealth by owning the property. At the end of the day, you still gotta live somewhere, you should at least try to have something of value at the end of the time.

What I would suggest doing is talking with a real estate professional to at least find out some details on what type of costs you can incur by owning a home. Learn about what types of closing costs you can expect and start to save up ahead of time for them. Ask the lender what you can expect your monthly payments will be and that will give you a good idea of what you can afford. Try to keep your mortgage payment within 30% of your take-home pay.

Be Prepared To Sacrifice

Just because a lender says you can afford the home doesn’t always mean you really can. The lender doesn’t always know how you like to live life. They don’t know that you like to take the family every year on a week long vacation to Disneyworld and that it normally costs you around $4,500 to do so. The lender also doesn’t know that you like to go out to eat once a week and take your spouse out on a date once a week for another $500. They only look at an equation to see if you can fit in, but doesn’t take any variables in like this. In short, you might need to sacrifice.

For a while you might need to do dates in, and family movie nights with a Redbox instead of trips to the movie theater to save up money. You might need to skip this year’s family vacation to Disney and instead do a staycation to allow you to save up enough money for a down payment. Bach suggests and I agree to at least try and save up 10% for a down payment. This way you own your home with a little equity to start and do not have to fret if the market slows down, or dips downward for a year or two. Also, if you can swing 20% down, you can then save of primary mortgage insurance which can be a hefty expense each month.

Reap The Rewards

At the end of the day, while buying a home can be a major expense, it can also be a major reward. Just like Bach stated, “The fact is, you aren’t really in the game of building wealth until you own some real estate.” If you are like my brother-in-law who recently bought a home in Portland Oregon and didn’t do it to make money, or you are making improvements not because you want to increase the value of your home, you are ultimately making a wise investment into your overall wealth by owning your home.

Contact me to learn more on the benefits of owning a home.