It’s almost April 15th or National Tax Day, so I figured what a great time to cover a rather boring topic, but a topic that everyone who is thinking of buying a home in Myrtle Beach needs to know information about, property taxes. South Carolina was ranked by USA Today as one of the most affordable property tax rates in the country.

In the article published in 2017, the average property tax for homeowner in South Carolina is $1,294. Personally, I think this is main reasons why we have so many people moving from areas like Pennsylvania ($3,900), New York ($7,013), Virginia ($3,181), Massachusetts ($5,513) & New Jersey ($8,477). Higher tax rates & more severe winter weather, are the main reasons Myrtle Beach has consistently been one of the top places to relocate the past few years.

I’m originally from Reading, Pennsylvania and moved to Myrtle Beach, South Carolina right after graduation with my family. My parents were tired of dealing with the snow and higher cost of living, so we wanted a change and Myrtle Beach was an area they had visited multiple times over the years so it was a perfect solution for us to move here.

When I started to write this article, I wondered what the average taxes are on the home we owned in PA in comparison to the home my wife & I recently purchased.

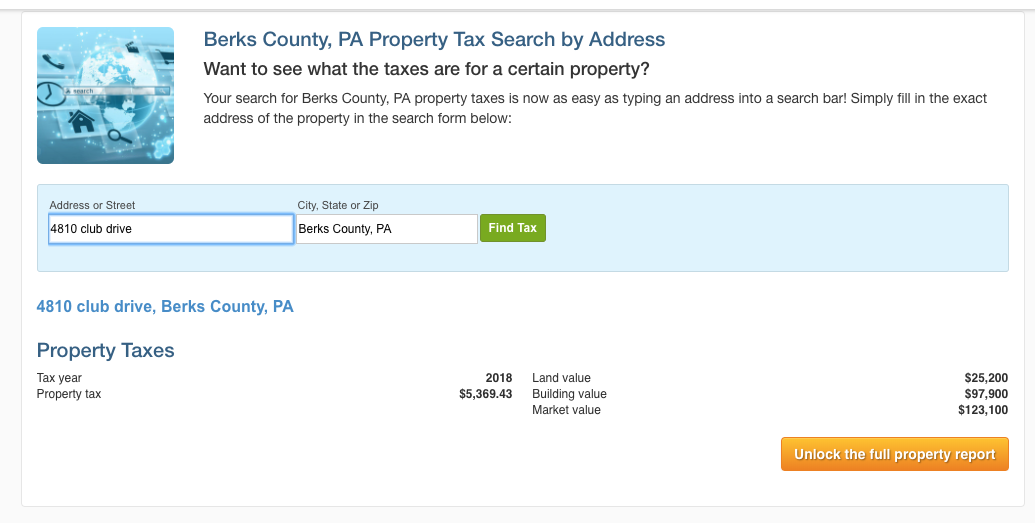

Below is the estimated taxes on the home I grew up in Reading, which I did verify were accurate with a fellow agent in Berks County.

As you can see, the home there is now assessed around $123,000 according to what I could find online with an estimated annual tax of $5,369.43. This number is more than 4 times the average for what a primary homeowner in Myrtle Beach pays on their property taxes.

In comparison, my wife and I purchased a home at the end of January in The Farm At Carolina Forest has an assessed value of $176,980, and the annual property taxes on this home were $746.65 last year. What this means is that the home I grew up in that is valued over $50,000 less costs over 7 times the amount of taxes then our home in Myrtle Beach.

Now, this average number of $1,294 for South Carolina is taking all parts of our state into the equation including Charleston where the average is over $2,000 due to a higher price point on property and also does not separate primary homeowners from out of state & multiple property owners.

Primary vs Secondary in Myrtle Beach

One thing we have to clarify when discussing taxes is to determine whether the home is going to be a primary ownership or second home/investment property. It makes a huge difference in the amount of taxes you will pay in Myrtle Beach.

When purchasing a home in Myrtle Beach, Horry County automatically taxes everyone at the secondary tax rate and each homeowner needs to prove residency to the tax assessor to get the discount. This means you are assessed at the 6% tax rate instead of the 4% tax rate.

When I bought my first property in Myrtle Beach back in 2006, I did not know this and my taxes on a townhome valued at $110,000 were over $1,900 per year. Coming from the north where taxes were more than 3 times that, I was happy and just went on with life. Then after living there almost 2 years I realized that I was not getting a South Carolina residency discount and so I took the necessary steps to get thing changed over and my annual taxes then dropped down to $636.

Homes owned in this area as a primary residence versus second home or investment, are usually half to one third the amount of taxes owed, so it is very important to get your taxes switched over when buying a home in Myrtle Beach.

Documents Needed For Legal Residence Application

Here’s what documents will be required to get the SC primary residence discount:

- SC Driver’s License/Identification card for owner occupants

- SC motor vehicle registration showing current address for owner.

- Copy of SC Voter Registration card

- First two pages of current tax returns.

Horry County now has the ability to apply online here for the primary residence SC tax rate or you can do so at the Horry County Tax Assessors Office with all the proper paperwork.

Other South Carolina Tax Discounts

There are other ways to save on your SC property taxes, that are only available to certain groups of people.

Veterans Tax Exemption

The first tax exemption is only available to our veterans. They must apply for this discount, but is a well deserved benefit for those who fought to protect our amazing country.

Homestead Tax Exemption

The second discount is the Homestead Exemption which is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

Just like the legal residence application, you must also apply for the homestead exemption in order to save. This too can be applied for online here.

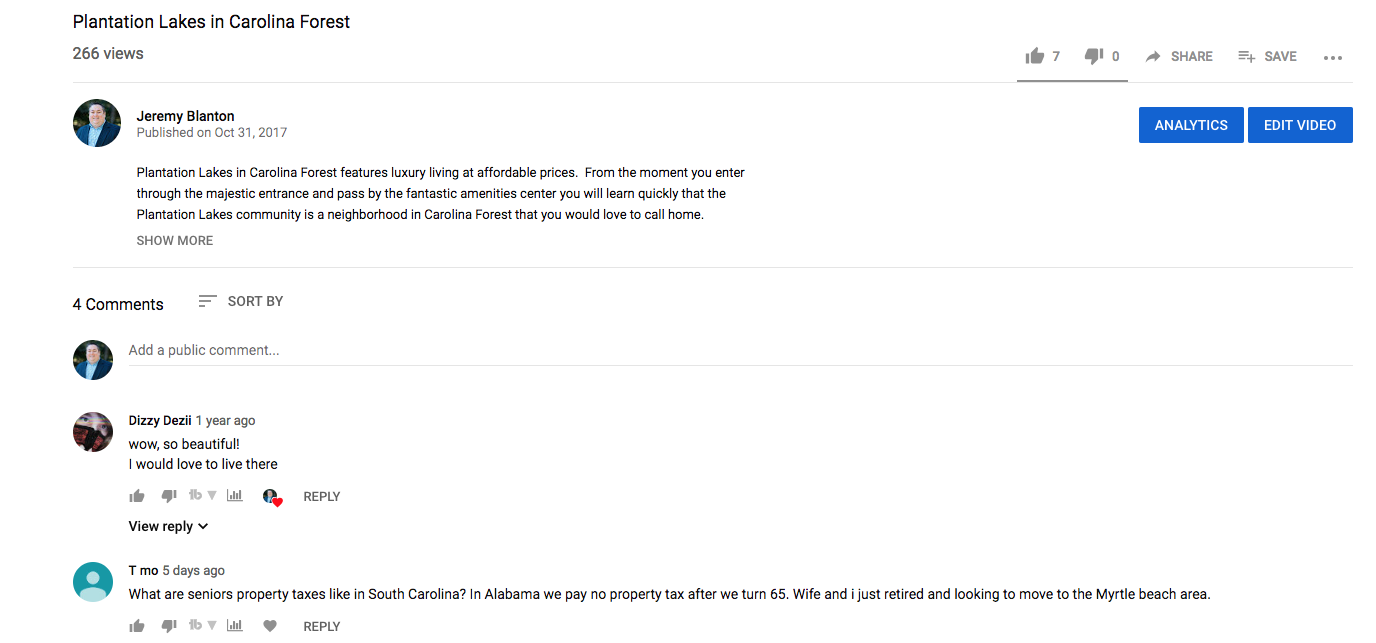

For people thinking of retiring to Myrtle Beach, taxes is a question that is definitely on their mind. I recently had this question asked on my video of Plantation Lakes on my YouTube Channel.

As someone who would be on a fixed income source, knowing the taxes in Myrtle Beach is something that can be very important to know and understand before purchasing a home here to live in for the rest of your life.

Vehicle Taxes in South Carolina

Now, while South Carolina ranks as one of the lowest places for property taxes, SC also collects taxes on vehicles. When you purchase a vehicle in SC there is a one-time infrastructure (IMF) rather than sales tax. This fee is 5% of the price up to a maximum of $500 that took effect in July 2017.

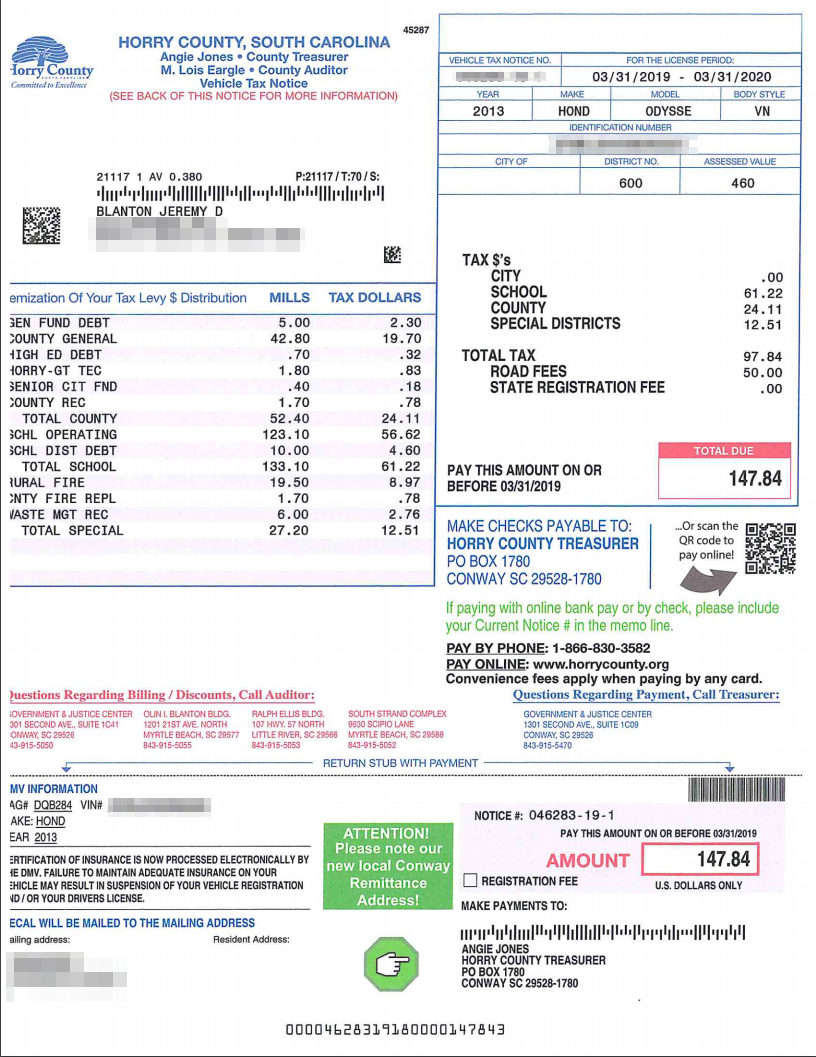

Then there is an additional tax that you will pay annually when renewing your tags for the vehicle. Last month I paid the bill for my 2013 Honda Odyssey. The total amount due was $147.84. Here’s a copy of the recent bill so you can see how it breaks down.

This bill changes each year as the value of your vehicle depreciates. So unless you are buying new $70,000 vehicles every year, your bills should be rather minimal. I also just recently got the bill for my other vehicle to pay and since it is newer it is around $480.

Understanding Myrtle Beach Taxes

If you combine the taxes on our home plus our two vehicles, we still are paying under $1,400 a year for all of our taxes to live in South Carolina which is only a fraction of what we paid when living in the north.

| Propety Taxes | $746.65 |

| Honda Taxes | $147.84 |

| Ford Taxes | $484.11 |

| Total | $1,378.60 |

So in conclusion, while you might pay taxes on more than just your home, in the long run, you are still going to save money in the long run when your property taxes on your Myrtle Beach home are so much less than other parts of the country.

If you are thinking of moving to Myrtle Beach, I’d love the opportunity to help you find a home here in the area. Feel free to call me at 843-222-9402 or contact me below with any questions you might have.