Over the past several months I’ve heard of real estate agents in our area getting fake offers, bogus pre-approvals, and other types of scams that are simply trying to capture the information of real estate agents. The main thing people are trying to access is your email inbox as they know that we help buyers purchase some of the largest investments in their life. Here in Myrtle Beach, once we have seen the home and written our offer, it is not uncommon to handle almost the entire rest of the transaction through email and phone calls with many times the buyer not even coming back to the beach from closing. This is why our area is a prime target for hackers trying to fool people into giving them money.

Now, the way that this type of scheme works is different than the age old days where people sent an email saying that a rich king in a foreign country has passed away leaving them hundreds of millions of dollars. I think in this day and age, that most everyone now realize that those are fake and that nobody falls for that any more. Instead, the criminals are trying all sorts of new techniques, one of which seems to be pretty consistent in the real estate industry.

Why Do They Do It?

Knowing that real estate agents assist people in making one of the largest purchases in their life, we are prime targets to try & steal money through. Hackers in other parts of the world target real estate agents because of the large amounts of money people will spend when purchasing a home. Think about it, our company average selling price right now on a transaction is around $193,000. If someone is purchasing a home and is only putting 20% down and financing the rest, that is still over $38,000. What if the person is paying all cash? That could be a major score for a hacker at once. Once the money gets wired into their account, they are almost immediately wiring the money out of the account to another country and covering the tracks as to where the money has gone.

This makes it almost impossible to retrieve the money once it has been sent and extremely difficult to recover if it has already been moved onto another account. In other words, once they get your money, it’s pretty much gone.

How Do They Do It?

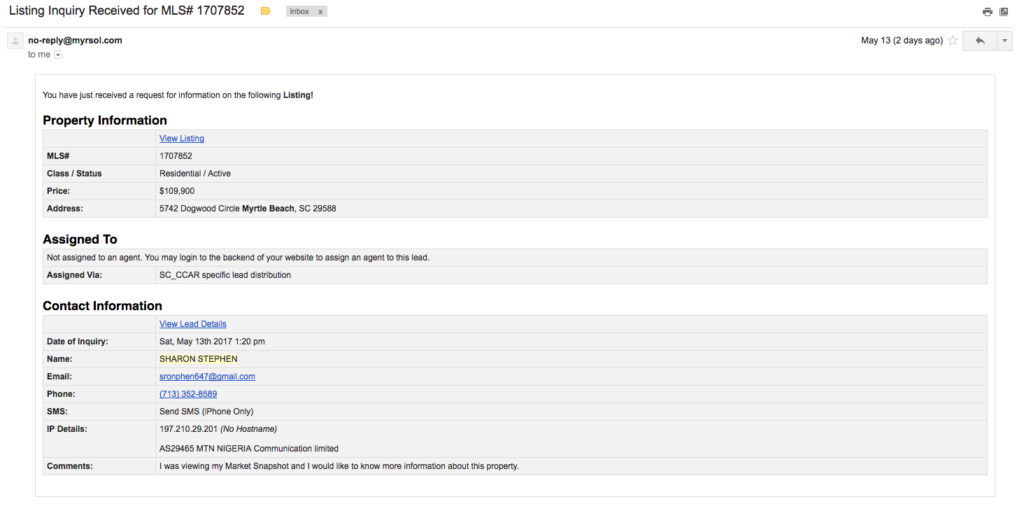

Now, unlike the bogus emails from someone in a foreign country trying to give us millions from a rich ruler, the tactics are much more advanced now. Instead, it normally starts with a simple property inquiry like I received the other day from “Sharon Stephen.” You can see the screenshot below of the email inquiry I received. This person was inquiring about one of my current listings on Dogwood Circle.

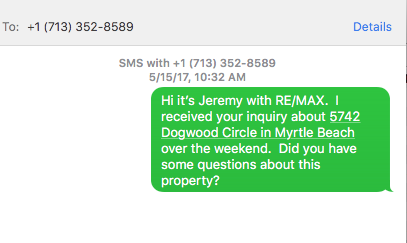

Like I do with all my online inquiries, I followed up with the person to see what additional information I could provide to them. Because I had a phone number and had not heard back from my voicemail & emails, I sent over the following text message as well to the phone number:

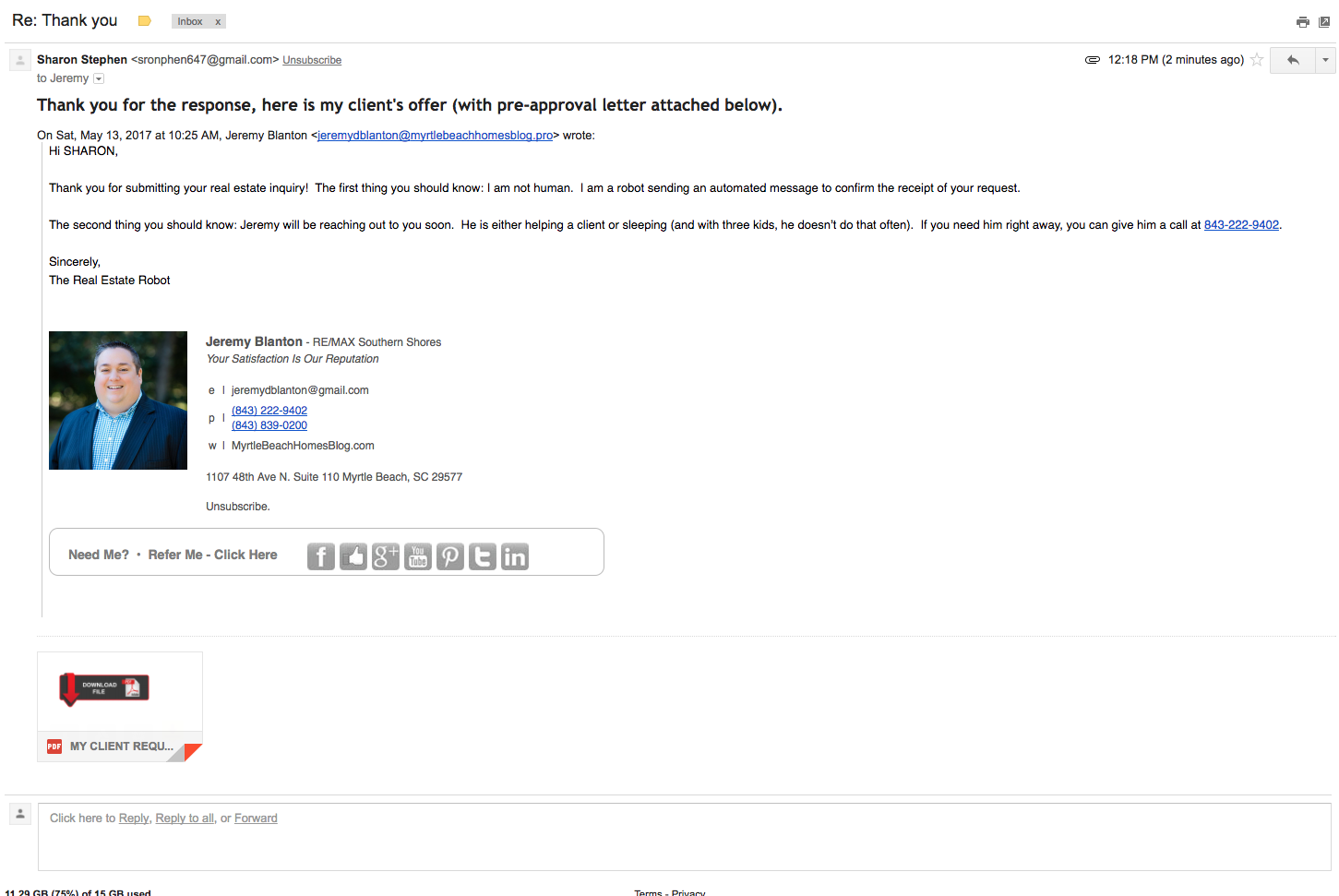

Approximately 90 minutes after sending this text message off, I received an email back finally from “Sharon.” But, when I received the email, I became instantly confused, because now “Sharon” had gone from being a interested buyer, to an agent representing someone and attaching an “offer (with pre-approval letter attached below)” on my listing.

Now as a sellers agent, I keep pretty close track of my listings and who has or hasn’t shown one of my properties so that I can give the highest level of safety to my sellers. I use an online program that tracks all showings on my listings so that if there is ever an issue in one of my properties, I can see who was there last and might be responsible. I first looked through that app to see that nobody by this name has shown my property ever. Next, I went into our local MLS program and searched to see if such a person even existed in our MLS to which I didn’t find anyone. In our previous market boom, it wasn’t uncommon though for someone to place an offer sight unseen on a property if it was something in a desirable area or price range, so I continued to try & track down who this person was. When both of these things brought back blank answers, I did one final step to see if this person was an actual real estate agent by doing a quick search on Google to see if I could find any information on this person by searching by name and also phone number. As a rule of thumb, most real estate agents have their name & phone number registered on several sites across the web, so even if this was a person brand new to the area and on their first week in real estate, I should be able to at least find something.

Just to make sure I wasn’t completely missing something, I decided I would at least try to look at the file that they sent as I could tell it was some sort of file attached to the email. When I clicked on what was supposed to be an offer in PDF format, it actually had a script attached to it that opened a link that looked like this:

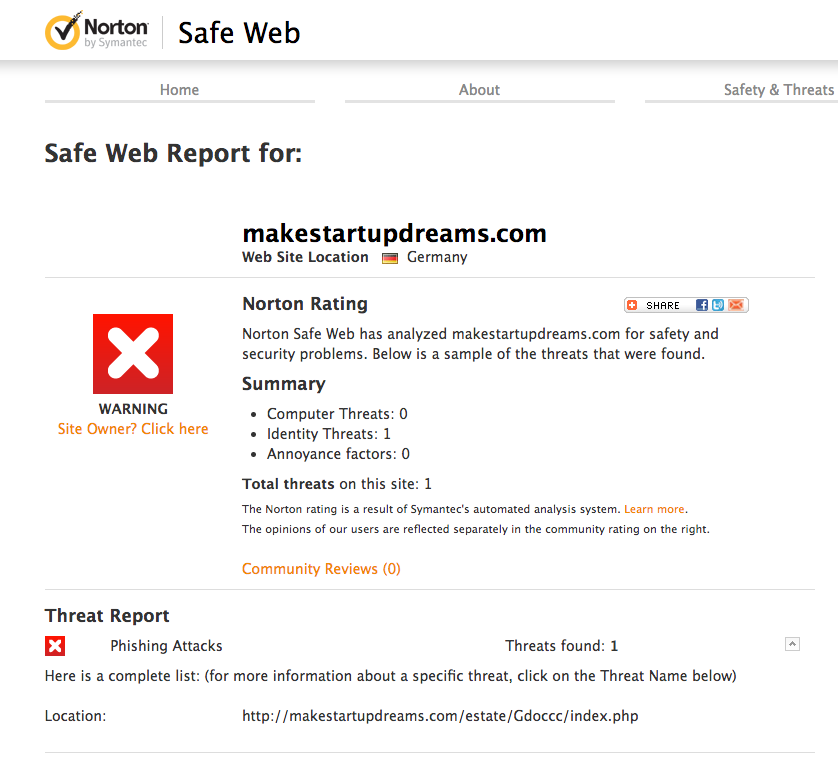

When I saw this pop up, I knew immediately this was a phishing scheme by someone who was trying to access my email so that they could try and steal money from my clients. Instead of clicking on the download file image and try to open an offer, I instead copied the URL attached to the image and headed to Norton Safeweb to make sure it was a bad site. If I had clicked on the image, it more than likely would have sent me a Google login page that would look similar to a normal login screen. However when I would have entered my information, it would have not shown me a file, but instead sent my login credentials onto the hack. Instead, here’s what Norton said about the URL:

Just as I suspected, it was all a bogus attempt to access my email. Now, unfortunately, not all agents are as tech savvy and knowledgeable on these schemes existing, luckily for me, my brokerage tries to stay on top of all these items and make all our agents aware of these scams. In fact, the National Association of REALTORS® shared about wire fraud a year ago.

What To Expect Out Of Me As Your Agent

So, here are a few things you can expect from me as your real estate agent:

- I’ll never ask you for confidential info- I have zero needs for ever having access to any of your banking information, social security number, etc. You will never get a text message or email from me asking for you to provide any of this sort of information. If any of this type of information is ever needed for a deal we are doing, you will be asked to provide this stuff directly to the lender or attorney. If you do receive an email from me, a lender, or attorney requesting this type of information or a change in wiring instructions, please contact me immediately and do not do what they request without at least speaking to a live human on the phone first.

- Most lenders & attorneys now use secure email servers- I know it’s a total pain when you have to log into an email server in order to respond or speak to an attorney or lender, but it is really for your best interest. It’s just another level of security to make sure your money and information stays safe.

- Always verify before sending confidential information- Before you ever wire money, or send over private/confidential information to someone, it doesn’t hurt to call them on the phone and make sure it actually came from them. I actually spoke to an attorney last week who said their company policy is to ALWAYS confirm numbers over the phone with someone before they send any funds, even if they have wired to this same account in the past. You can never be too secure when transferring large amounts of money electronically.

- My email is as secure possible- I’ve taken all the necessary precautions to make sure my email is as safe as possible. This means I use an ultra secure password, change it regularly, and also have the two step verification set up as well for extra protection. Also, I’ve placed a disclaimer on the bottom of my email signature to remind everyone I email that I will never request or send any type of information regarding wiring funds.

Ultimately, you work hard for your money and I want to do as much as I can to make sure your information is safe and secure so that when you are trying to purchase a home, it gets used for just that. So, like I mentioned above, if you ever get any type of correspondence from me asking for private information, please do a few things:

First, do not automatically do what the email requests you to do. Second, forward the email to me immediately and then lastly, please pick up the phone and call me at 843-222-9402 immediately to let me know that such thing was requested by my email. Your identity and money is too important to allow it get into the wrong hands.

As a REALTOR® many think that my only job is to help someone buy or sell a house, but we do much more. As I began my crazy day today, I thought I would give everyone a quick glimpse into what all a REALTOR® does which is beyond just helping someone buy or sell a home. This is all what happened this morning by 9:30 AM.

As a REALTOR® many think that my only job is to help someone buy or sell a house, but we do much more. As I began my crazy day today, I thought I would give everyone a quick glimpse into what all a REALTOR® does which is beyond just helping someone buy or sell a home. This is all what happened this morning by 9:30 AM.