Congratulations! It’s almost closing day and you are excited to purchase that fantastic home in Myrtle Beach! Your agent has helped you through the search process, connected you with a lender for the loan, helped you find the right closing attorney, negotiated repairs on the home, and we are now only a few days from closing!

But, you are stressing out because nobody has given you a final amount you will need for closing to transfer yet. Unfortunately, here in Myrtle Beach, it is fairly common for the final figures to not be ready until just a day or two prior to closing.

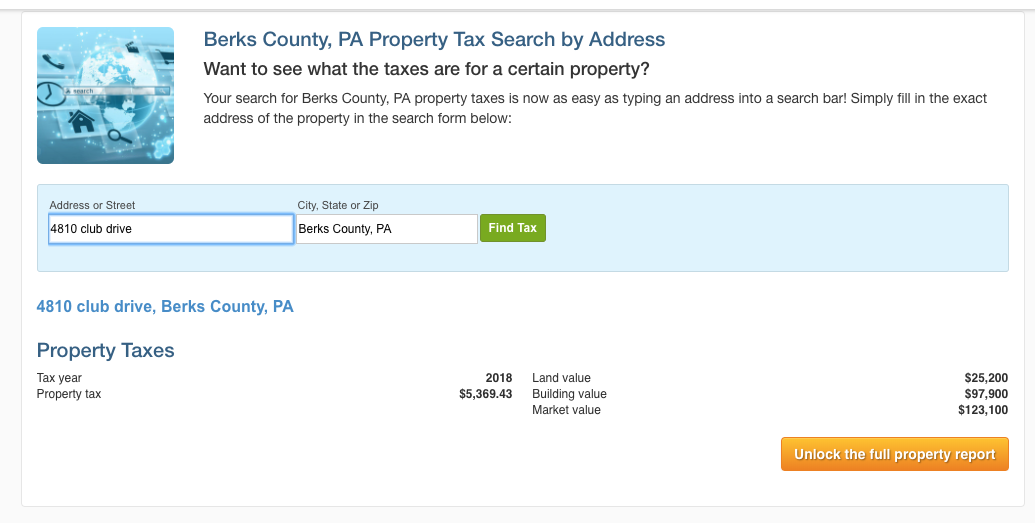

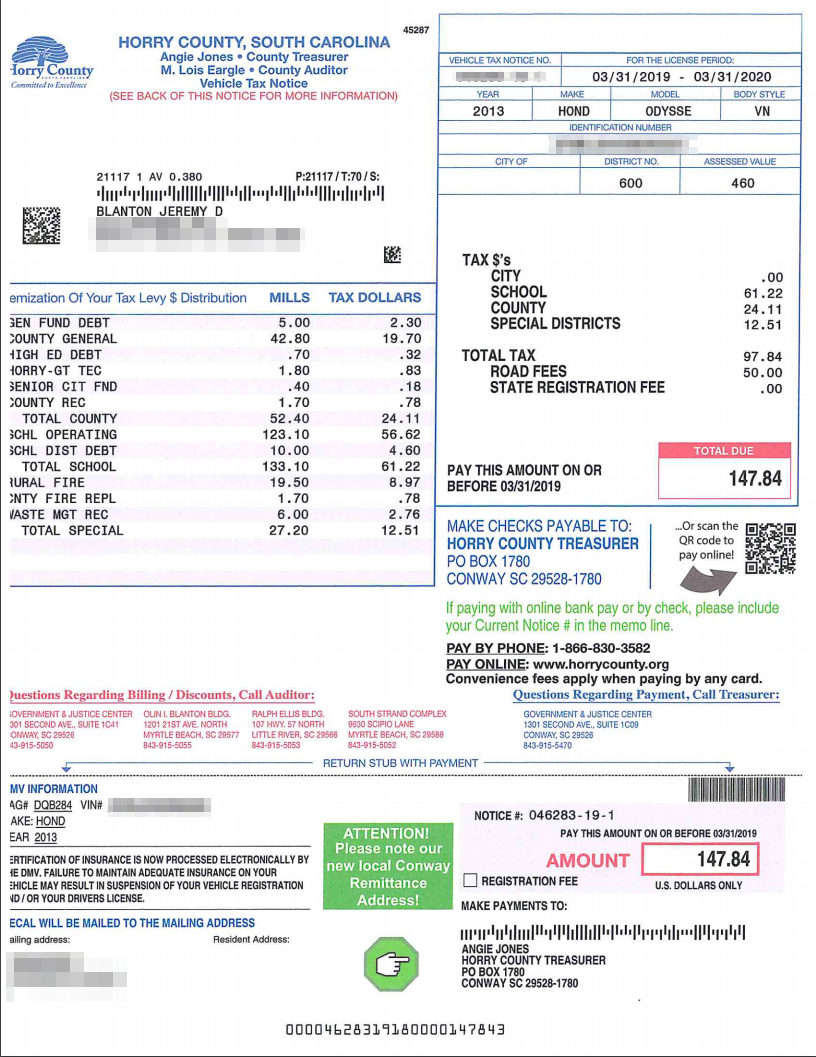

There are a lot of things that factor into when the final amounts are calculated and each and every thing gets figure down to the day. So things like taxes, HOA dues, interest, all are calculated to the day. This means if you close on the 31st of a month versus the first can alter those numbers greatly that are due on the day of recording. That being said, attorneys & lenders do not have the final amounts calculated until there is a clear to close notice given from the lender.

Once that is given, everyone can then plan for that day, start calculating and give you final numbers of how much will be needed for the day of closing.

So, if you are stressed about not knowing how much just yet, do not stress, it is normal, and nothing to worry about. You will get that number and then be able purchase that awesome Myrtle Beach Home.