When buying a home in Myrtle Beach, should you get a home inspection done? What will the home inspector check when going through the property? I’m going to cover this topic in today’s Two Minute Tuesday Video:

Should I Have A Home Inspection Done When Buying a Home In Myrtle Beach?

When you are buying a house, one of the things I always suggest is for my buyers to get someone to do a professional home inspection of the home. This means hire a licensed insured home inspector to come into your property and check everything about it. It will cost a few hundred dollars and take the person a few hours, but they will do a full and complete walkthrough of the property to make sure there are no major issues found throughout the property. Now in Myrtle Beach, they are going to check for five main areas of the house. They are not going to cover things that are cosmetic though. So you want to make sure when you are doing your contract if you see something cosmetic like a cracked tile or chip in the wood that you put those things are written into your contract to get them addressed.

Five Areas Checked

When a home inspector comes into the property, they are going to go over the entire property and do visual inspections of everything, but they are going to focus into these 5 main areas:

- Structure

- Heating/Cooling System

- Plumbing

- Electrical

- Appliances

These five areas are what a South Carolina Residential Agreement directly talks about in the contract. If the item mentioned by an inspector does not fall under one of these 5 categories, then it’s possible the seller will resist taking care of the item.

Structure

Let me start by stating this, your inspector is not going to do a full structural inspection of your home. In order to do that, you would need to hire a structural engineer who has specific training to handle such a thing. What a home inspector in Myrtle Beach is going to do instead is a visual inspection of the property. They are going to make note of any defects or things that look out of the normal. If they see a crack in the foundation they will alert the buyer of it. If the buyer has greater concern based on the findings in this original report, they could then hire a structural engineer to come out to the property and do a specific structural inspection of the home.

The home inspector is also going to check the roof to make sure there are no leaks noticeable to the eye. They will go into the attic and make sure that nothing is out of the ordinary. That there is the proper amount of insulation present to keep the home insulated right. If they see any signs of a prior leak, they normally have a moisture meter that they will then test the affected area to see if it just a stain from previous issue or if it is something that is current and needs to be addressed immediately. They will walk around the exterior of the home and make note of any wood rot, or damage caused by wood destroying organisms as well.

Heating/Cooling System

The second main area the inspector is going to focus on is your HVAC system. Now, home inspectors as a whole are not normally experts on everything related to your heating & cooling system, but, they are going to do a full visual inspection of your equipment. They are going to make sure that if it’s a hot summer day the air conditioning is working and making cool air. If it is a cold winter day, the heat is working properly and it’s making warm air. They are going to note the age of the unit, and make sure that there are no leaks on any of the lines and that all dr

ains are properly installed and that drain pans are in place.

They will open up your filters and make sure that they are clean and that the coils in the unit are also fairly clean and free from any debris that could cause the unit to work hard and thus wear out quicker. They will also run tests to check the outflow vs intake of air temps. They will use their best skills to make sure your system is running optimally.

Plumbing

During a home inspection in Myrtle Beach, they are going to check this third section, the plumbing systems. While they aren’t going to be able to see what is going on behind the drywall, they are going to test all your faucets throughout the property and make sure that they are working properly. They are going to look under the sinks and make sure that when the water drains out that it is not leaking.

The inspectors are going to make sure your drain plugs are in proper working order and that there are no leaks in the faucets. The home inspector is going to give you all kinds of information about your hot water heater like it’s age, size, whether it has an expansion tank, if it is heating water to a proper temperature without being too hot. They will make note of the temperature to make sure you do not get scalded when taking a shower, or placing a child into a freshly drawn bath.

Electrical System

Next, the inspector is going to go the electrical box and they are going to check to make sure that there is nothing faulty in there. They will make note of the amperage in the box. They will do a thorough inspection of the panel to make sure that somebody didn’t take a circuit breaker and stick it in on their own, improperly. This could be a major fire hazard that could burn your house to the ground at any moment if not addressed.

The inspectors are going to go to every single outlet in the home and make sure they are working properly and are grounded. They are going to test the GFCI outlets in your kitchen and bathrooms to make sure they are shutting off when surged to keep you protected. They will check all the lights in the home and make sure they work properly as well.

Appliances

The fifth and final area they are going to test are the appliances. The home inspector is going to make sure that your dishwasher is running properly and free of leaks. That your garbage disposal doesn’t make a clanking noise when turned on because something is stuck in it. That the ceiling fans are not wobbling and about to fall down. He’s going to make sure that all appliances are in working order as of that day.

This does not mean that the week after closing that one of the appliances might break down. They are machines that can break down at any moment. When we moved to the area, we had bought a fairly new home and one month after moving into the home, the refrigerator that was only 3 years old broke down and wasn’t cooling any more. Luckily we had purchased a home warranty that covered us and we only had to pay a service call to have someone come and fix it. This is one of the many reasons I also recommend my clients get a home warranty when purchasing property. It gives you an added level of protection for that first year of ownership for a minimal fee.

Wrap Up

These are the five areas that the home inspector is going to check when they come into your property. While it does cost you some money to hire them to do the inspection, I hope I have now given you a much clearer explanation of what is covered so that you can see the value in hiring one when purchasing your next home in Myrtle Beach. When completed, they will provide you a very in depth report of just about anything and everything you would ever want to know about your new property you are buying.

If you have any more questions on what a home inspection covers when buying a home in Myrtle Beach, or anything else related to buying or selling a home in Myrtle Beach, feel free to reach out to me. You can either call me at 843-222-9402 or use the contact form to email me directly.

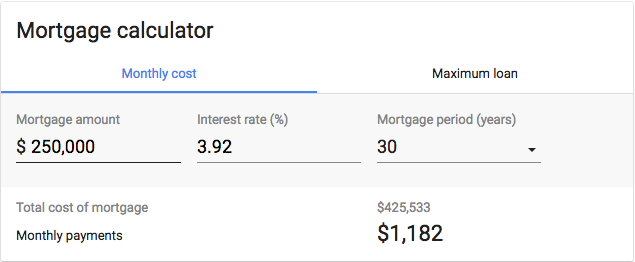

I just finished reading thought provoking article on CNBC where they did an interview of self made millionaire David Bach on how to build wealth. In this article, he states that for a millennial to start building wealth for their future, they need to invest in real estate.

I just finished reading thought provoking article on CNBC where they did an interview of self made millionaire David Bach on how to build wealth. In this article, he states that for a millennial to start building wealth for their future, they need to invest in real estate.

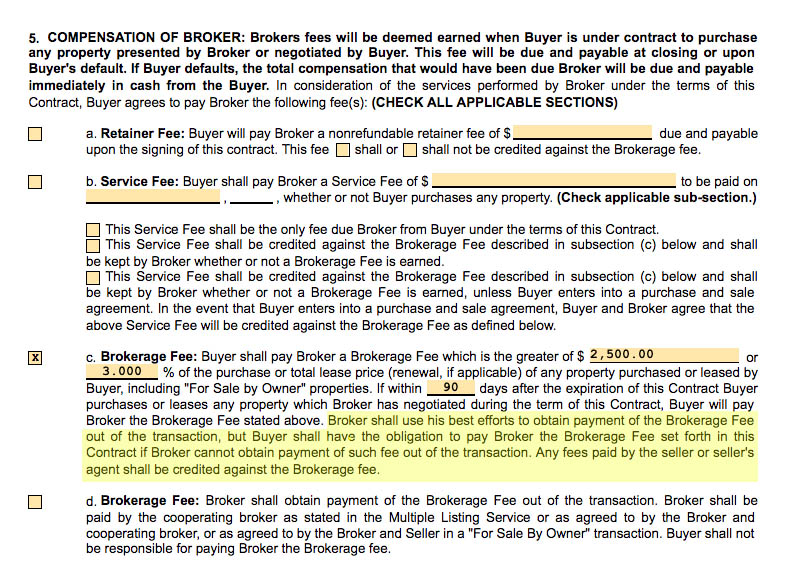

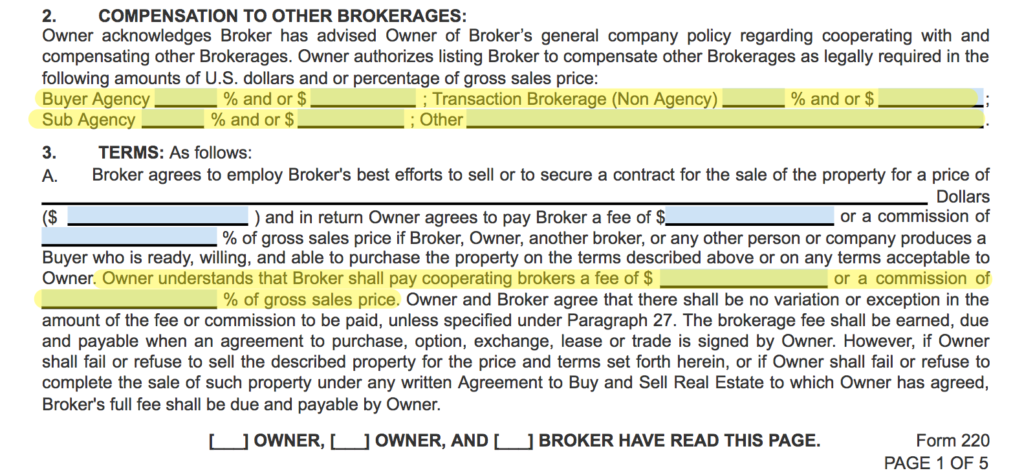

Today I want to share a story of something that recently happened to me with some of my good friends. Now, before I begin, this is not a story about me complaining about losing money, but more so a story I share to try & help others who are looking to buy a home in Myrtle Beach, SC or basically anywhere else in South Carolina. I cannot speak that this is the same case for anywhere else in the country as I am only licensed for this state.

Today I want to share a story of something that recently happened to me with some of my good friends. Now, before I begin, this is not a story about me complaining about losing money, but more so a story I share to try & help others who are looking to buy a home in Myrtle Beach, SC or basically anywhere else in South Carolina. I cannot speak that this is the same case for anywhere else in the country as I am only licensed for this state.